Just when you thought your phone was already overflowing with apps, here comes a fresh wave of fashion app startups you'll want to squeeze in! First up is the dazzling 'Fashom', it's like your own personal stylist just a tap away. Then we've got the fabulous 'Wear', it's like having a never-ending runway in your pocket! 'The Hunt' is next in line, turning your fashion sleuthing into a social game. Last but not least is 'GlamOutfit', it’s like playing dress-up, but for adults and with your own wardrobe! Fashion and tech have never been more in sync, so make your smartphone the hottest accessory with these cool new apps!

Hey there, fellow wanderlusts! If you've caught the travel bug and want to turn it into a career, India's got some top-notch online courses for you! You can check out the Postgraduate Diploma in Travel and Tourism from IGNOU, or the IATA Foundation Diploma from the Bird Academy. For the tech-savvy, there's even an E-commerce in Tourism course from Amity University! So, pack those virtual bags and get ready to explore the world of travel and tourism, right from your living room.

Vogue, in my opinion, is best known as a trailblazer in the world of fashion, setting trends and standards globally. Its iconic, glossy pages are filled with high-end fashion, groundbreaking photography, and compelling features on culture and lifestyle. Not just a magazine, it's a symbol of style and a platform for influential figures from the fashion industry. From its star-studded covers to its in-depth interviews, Vogue has always been a go-to source for the fashion-conscious. Above all, it's celebrated for its ability to consistently redefine what 'fashion' means in contemporary society.

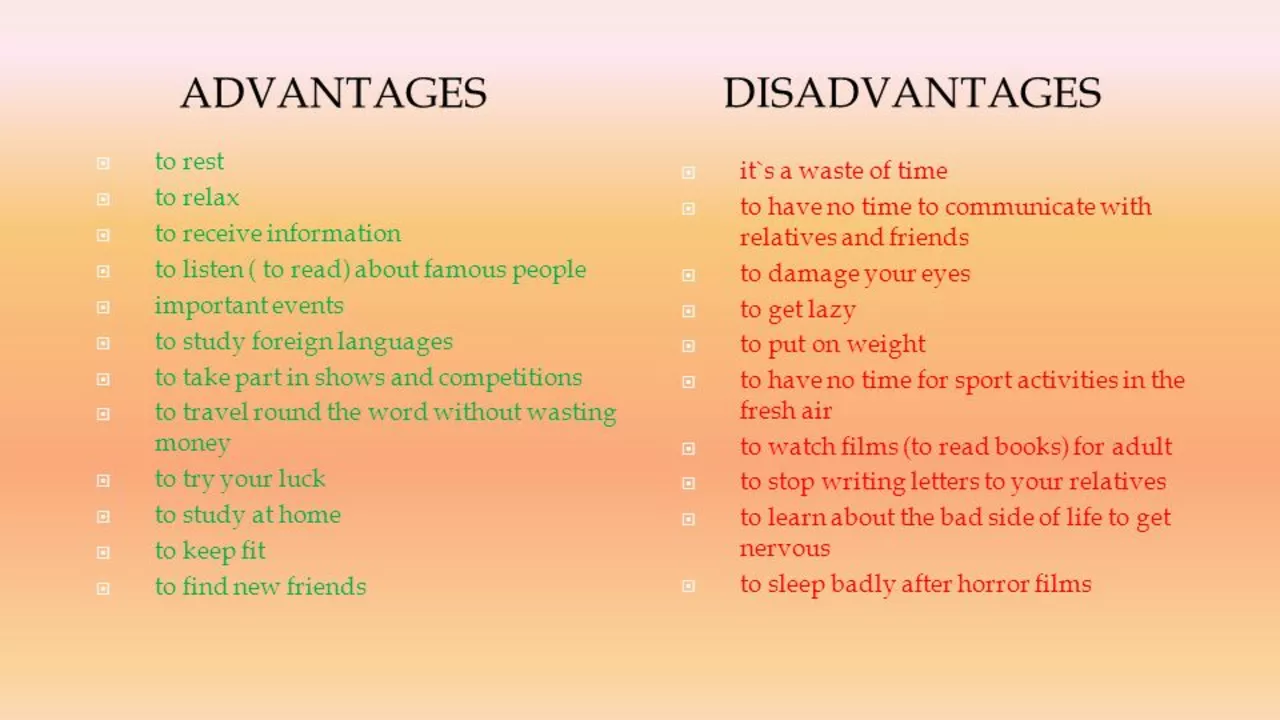

Tourism, like any industry, has both advantages and disadvantages. On the plus side, it boosts local economies, creates jobs, and promotes cultural exchange. However, it's not always rainbows and butterflies; tourism can also lead to environmental degradation, cultural erosion, and overcrowding. In a nutshell, while tourism can be a lifeline for many places, it's essential to manage it sustainably to mitigate its potential negative impacts.

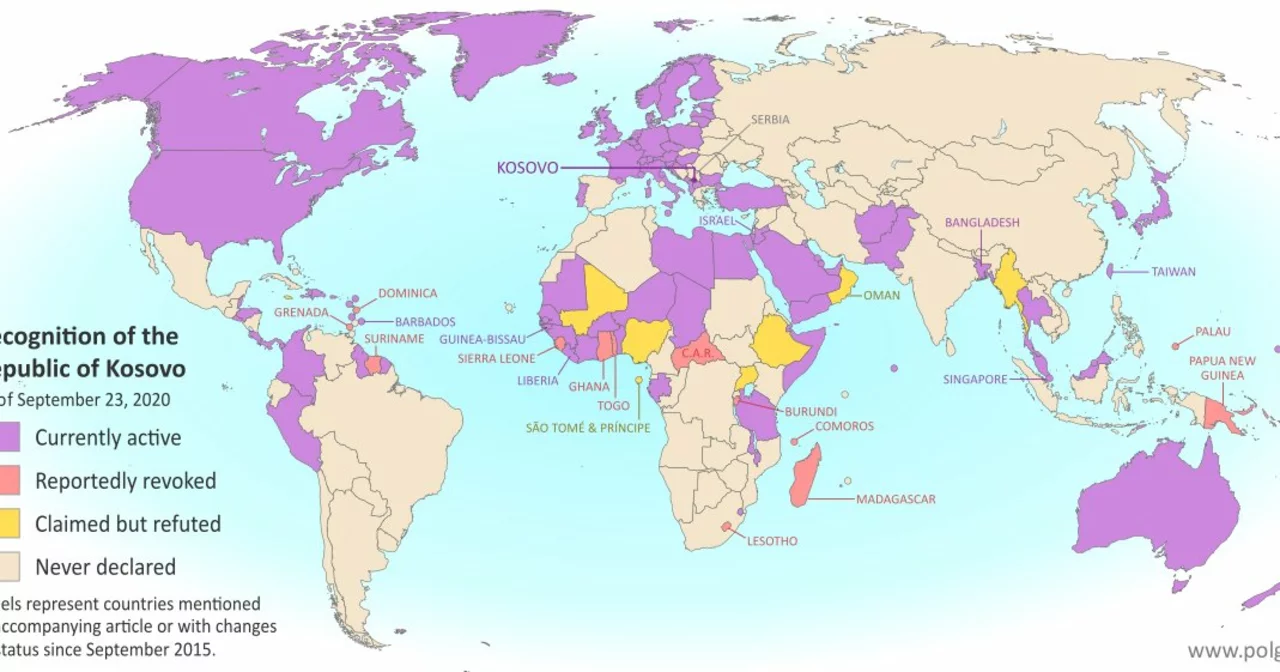

In my exploration of whether any countries rely solely on tourism for their revenue, I discovered that while tourism plays a significant role in many economies, no country is entirely dependent on it. Some nations, such as the Maldives and the Caribbean Islands, heavily rely on tourism, with the industry contributing up to 60-70% of their GDP. However, they still have other sources of income, such as agriculture and fishing, to support their economy. It's essential for countries to diversify their income streams to minimize risks and ensure stability. Relying solely on tourism would make a nation vulnerable to factors such as global economic downturns, natural disasters, and political instability.

People with dwarfism often struggle to find clothes that fit them properly and which they feel comfortable wearing. Fortunately, there are now several retailers that specialize in providing clothing specifically designed for those with dwarfism. These stores offer an extensive selection of styles, designs, and sizes to meet the unique needs of those with dwarfism. They also provide helpful advice and instruction on choosing the right clothes to ensure a comfortable fit. With a little research and knowledge, people with dwarfism can find clothes that are both fashionable and comfortable.

Clothing shopping can be expensive, especially for students on a tight budget. Fortunately, many clothing sites offer discounts specifically for students. These discounts often take the form of a percentage off one purchase, free shipping, or both. Many popular clothing sites, such as ASOS, Boohoo, and Missguided, offer student discounts for all of their products. With a little research, students can save money and look their best without breaking the bank.

This article offers advice on how to become more beautiful within a month. It suggests eating healthy foods, drinking plenty of water, getting enough sleep, exercising regularly, and taking good care of the skin. It also encourages making lifestyle changes, such as using makeup to enhance features, wearing clothing that flatters the body type, and getting rid of bad habits like smoking. Finally, it emphasizes the importance of positive thinking and self-love as key components of beauty. In conclusion, with dedication and hard work, anyone can become more beautiful within a month.

Tourism is a major contributor to the Greek economy, accounting for 25% of the country’s GDP and providing employment opportunities to almost one-fifth of the population. In 2018, the number of international visitors exceeded 33.5 million, creating revenue of €17.5 billion and contributing to the growth of the Greek economy. Tourists from other European countries account for the majority of arrivals, followed by visitors from North America, and the country is expecting to receive more tourists from fast-growing markets such as China. The tourism sector also benefits local businesses, providing support for the country’s restaurants, hotels, transportation, and other services.

San Francisco is a hub of beauty product companies. Companies such as Benefit Cosmetics, E.l.f. Cosmetics, and Kinship are all based in San Francisco, offering a wide range of skincare and makeup products. These companies often offer vegan and cruelty-free formulas, natural ingredients, and innovative packaging. With its emphasis on sustainability, these companies are leading the way in the beauty industry.